All-in-One 2026 Budget Planner Template For Free

Quick Navigation: Jump to Your Favorite Budget Tracker

Navigate your free 2026 budget planner template with ease! Click any link below to jump directly to bill trackers, debt payoff sheets, savings challenges, or monthly budget templates. Save time and start organizing your finances in seconds.

01. Why a Printable Budget Planner Beats Apps for Real Financial Control

02. What's Inside Your 2026 All-in-One Budget Planner (15+ Trackers)

Full-Year Calendar + Bill Tracker

Never miss a payment again. Each month features a clean calendar layout with dedicated columns for due dates, amounts, and payment status. The annual bill tracker (January–December view) helps you spot seasonal spending spikes—like holiday gifts or car insurance renewals—so you can prepare months in advance.

Weekly Expense Logs with Category Breakdown

Daily spending leaks sink budgets faster than big purchases. This planner includes dedicated weekly grids where you log every transaction under five core categories: groceries, transportation, dining out, shopping, and “other.” After three weeks, you’ll spot patterns apps bury in analytics dashboards—like that $5 daily coffee habit costing $150/month.

Debt Payment Trackers (4 Creditors)

Pre-formatted tables for four debts include columns for interest rates, minimum payments, and running balances. Use it for either the debt snowball (pay smallest debts first for psychological wins) or avalanche method (target highest-interest debt first for math efficiency). No calculations needed—just fill in your numbers and watch progress accumulate visually.

52-Week Savings Challenge Built In

Sinking Funds Organizer

Net Worth Dashboard

Bill & Subscription Audit Calendar

03. How to Use This Planner Without Burning Out (3 Simple Rules)

Rule 1: Spend 7 minutes every Sunday—not daily

Batch-process receipts while your coffee brews. Update balances, transfer last week’s spending to monthly totals, and plan cash envelopes for the week ahead. Research from the University of Southern California shows weekly financial check-ins create 3x higher adherence than daily tracking—because life happens, and rigid systems break.

Rule 2: Start with ONLY 3 trackers

Overwhelm kills momentum. For your first 30 days, use just:

- Monthly Budget page (income vs. fixed expenses)

- One Weekly Expense Log

- ONE goal tracker (debt or savings—not both)

Add other sections only after these feel automatic. As productivity expert James Clear writes in Atomic Habits, “You don’t rise to your goals—you fall to your systems.”

Rule 3: Embrace imperfect tracking

Missed three days? Spilled coffee on a page? Don’t quit. Just restart. Behavioral economists call this the “fresh start effect”—our brains respond powerfully to small resets (Monday, the 1st of the month). Perfectionism is the enemy of progress. Consistency—even messy consistency—builds lasting change.

04. 3 Budgeting Methods to Pair With Your Planner (Choose Your Style)

Method A: Zero-Based Budgeting (Dave Ramsey Style)

Assign every dollar a job so income minus expenses equals zero. Use the Monthly Budget section to allocate funds until nothing remains unassigned. Ideal if you’re debt-free or aggressively paying down debt. Warning: requires upfront planning but eliminates “where did my money go?” anxiety.

Method B: 50/30/20 Rule (Elizabeth Warren’s Framework)

Divide after-tax income into:

- 50% Needs (rent, utilities, groceries)

- 30% Wants (dining, hobbies, shopping)

- 20% Savings/Debt

Use the planner’s category columns to color-code spending. Best for beginners wanting structure without rigidity.

Method C: Envelope System (Digital-Friendly)

Withdraw cash for variable categories (groceries, entertainment) weekly. Use the Weekly Expense Log as your “envelope register”—when the column fills, spending stops. Modern twist: keep money in separate bank accounts labeled “Groceries” or “Fun Money” instead of physical envelopes.

05. Frequently Asked Questions

Q: Can I share this PDF with my blog readers or email list?

A: No—this planner is licensed for PERSONAL HOUSEHOLD USE ONLY. Sharing the PDF file violates copyright. You may share a link to this blog post so others can download their own copy.

Q: Is this a substitute for financial advice from a professional?

A: Absolutely not. This is an educational tracking tool to build awareness. For complex situations (bankruptcy risk, retirement planning, investment allocation), always consult a certified financial planner. Tools track—professionals strategize.

Q: How is this different from free apps like Mint or EveryDollar?

A: Three key differences:

- Privacy: No bank account linking = no data sold to advertisers

- Simplicity: Focuses on the 3 habits that move the needle (spending awareness, bill planning, goal tracking) without overwhelming features

- Psychology: Tangible progress builds lasting habits better than digital notifications

Q: What if I’m terrible at math or budgeting?

A: No calculations required! Every section includes pre-formatted “Total” rows where addition happens visually. Just write numbers in columns—the layout does the math. Start with one weekly expense log. That’s it. You’ve already begun.

Q: Can I use this for business finances?

A: No—this planner is designed for personal/household finance tracking only. Business finances require separate tracking for tax compliance and liability protection. Consult a CPA for business budgeting systems.

Your Next Step (No Perfection Required)

Disclaimer: This free 2026 Budget Planner PDF is for PERSONAL USE ONLY. Resale, redistribution, or commercial use is strictly prohibited. This content and planner are educational tools only—not professional financial, legal, or tax advice. Always consult a certified financial planner (CFP®) for personalized guidance regarding your specific situation. Results vary based on individual circumstances, discipline, and economic factors. No income promises or debt elimination guarantees are made.

Download Your Free 2026 Budget Planner (Personal Use Only)

Ready to simplify your money management? This printable PDF includes all 15+ trackers described above—optimized for US Letter and A4 paper with light ink usage (no heavy graphics).

Format details:

- Print-ready PDF (single pages + booklet option)

- Light ink design—under 5% coverage per page

- Hyperlinked table of contents for digital use

- Bonus: Print “Monthly Budget” and “Bill Tracker” pages on cardstock for your kitchen command center

IMPORTANT DISCLAIMER:

This free 2026 Budget Planner PDF is for PERSONAL USE ONLY. Resale, redistribution, sharing via email lists, or commercial use is strictly prohibited under copyright law. This planner is an educational tool—not professional financial advice. For debt crisis situations, investment decisions, or tax planning, consult a certified financial planner (CFP®) or licensed advisor.

Explore More Free Planning Resources

You may also find these resources helpful:

- Free Trackers & Habit Tracking Printables

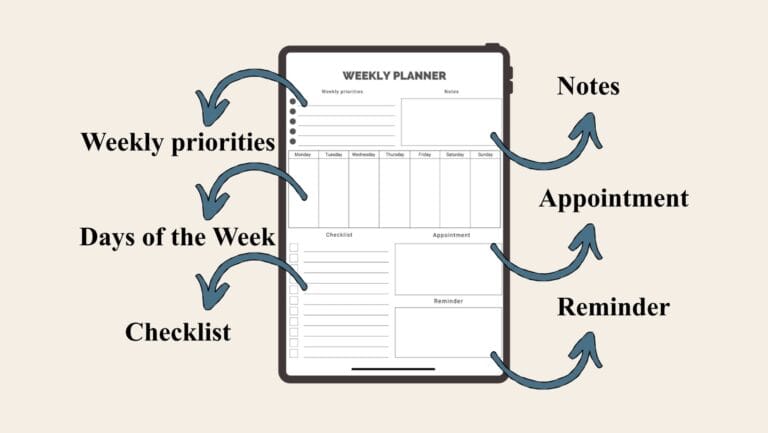

- Free Digital Planners & Printable Planner PDFs

- Free Digital Journals & Printable Journal PDFs

- Goal Planners and Productivity Tools

These tools are designed to support organization and clarity in daily